- Oct 12, 2025

📉 Share Price Drop: Market Forces or D&O Misconduct?

- D&O Training Hub

- 0 comments

But how can we know if D&Os are responsible and liable when there is a drop in share price?

The key is to determine whether the stock price drop was caused by a material misstatement or omission made by the company’s directors and officers.

If that is the case, under U.S. securities laws, specifically under Rule 10(b)5, there is a high risk that D&O will face a securities class action against the D&Os, which in turn can result in a claim on the D&O insurance policy.

However, a sudden drop in share price can also result from market forces that are entirely unrelated to the director’s actions.

Distinguishing whether a sudden decrease in share price is due to market forces or to directors’ and officers’ misstatement or omission is not always straightforward.

To illustrate this, let’s look at Apple Inc.'s historical share price, which is listed on the NASDAQ in the USA.

The two stock price charts below show an actual drop in Apple Inc.’s share price, but only one resulted from an alleged misstatement or omission by the D&Os and, in fact, led to a securities class action against its directors.

Can you tell which one it is?

Chart A)

APPLE Inc. / From April 2nd to April 8th, 2025 / Share price drop of 23%

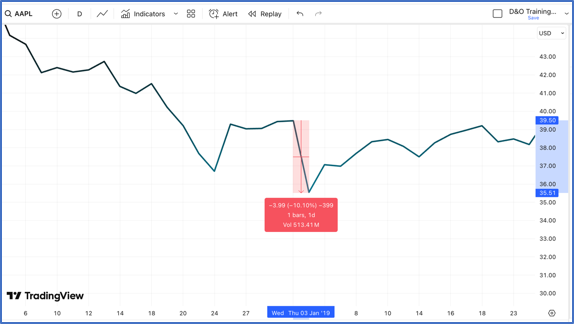

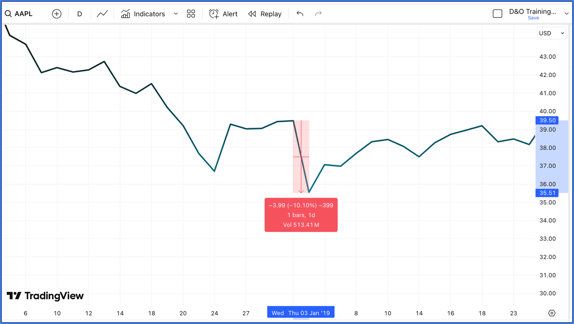

Chart B)

APPLE Inc. / January 3rd, 2019 / Share price drop of 10%

If you selected chart A), you made the wrong choice.

In the case of Chart A, the decrease in share price of Apple Inc. was the result of President Trump’s “Liberation Day” Tariffs Announcement on April 2, 2025.

On that day alone, Apple lost nearly 10% of its value, but many other companies lost significant value as well. In this case, the drop in share price was not caused by a misstatement or omission by its D&O, but rather the result of external market forces.

If you selected Chart B, then you made the right choice.

Indeed, the drop in share price illustrated on chart B) was allegedly the result of a director or officer’s misstatements and led to a securities class action against Apple and some of its directors, including the CEO, Tim Cook, and CFO Luca Maestri.

🔍 Facts & Allegations

CEO Tim Cook and CFO Luca Maestri allegedly made statements in November 2018 about strong iPhone demand in China. Around the same time, Apple told suppliers to cut back production.

On January 3rd, 2019, Apple issued a rare revenue guidance cut, lowering its Q1 2019 revenue forecast by as much as $9 billion, largely due to weak iPhone demand in China.

Apple’s stock fell about 10% that day, wiping out over $70 billion in market capitalization, resulting in billions of dollars in losses for shareholders.

Then in January 2019, Apple sharply revised its revenue forecast downward by up to $9 billion, largely blaming weak demand in China.

Legal actions:

Shareholders (the plaintiffs) started a lawsuit in which they alleged misrepresentation (false or misleading statements) and omissions under U.S. securities laws, specifically under Rule 10(b) of the Securities Exchange Act of 1934, asserting that Apple's earlier positive commentary about iPhone’s demand in China misled investors.

Apple denied the allegations and filed a motion to dismiss the case, basically arguing that its statements about iPhone demand were not misleading.

In 2020, the Court denied in part Apple’s motion to dismiss.

The complaint survived on core claims — i.e., the Court found that plaintiffs adequately alleged that China-related statements were materially false or misleading at the time they were made.

Eventually, Apple agreed to settle for $490 million

The example above shows that a share price drop alone is not enough to determine if D&O misled investors!

For companies with shares listed on a US stock exchange, determining whether a share price drop resulted from a misstatement can be complex.

According to securities laws in the USA, specifically Rule 10(b)5 of the SEC Act of 1934, to allege that a decline in share price was caused by D&O misstatement and omission (and not by pure market or economic forces), shareholders (plaintiffs) are required to prove the six elements below:

1. Manipulation or Deception (through misrepresentation and/or omission);

2. Materiality;

3. Reliance (“fraud on the market”);

4. "In Connection With" the purchase or sale of securities;

5. Scienter;

6. Damages Caused by the Misrepresentation or Omission (“Loss causation”)

Each of the elements above has its own specifics, and each requires a full explanation.

If you want to learn the details of each element, we invite you to read our articles on USA securities legislation essentials or follow our master classes on securities exposure in the USA, parts 1 and 2.

Disclaimer: This article is for illustration purposes and should not be considered legal or underwriting advice.